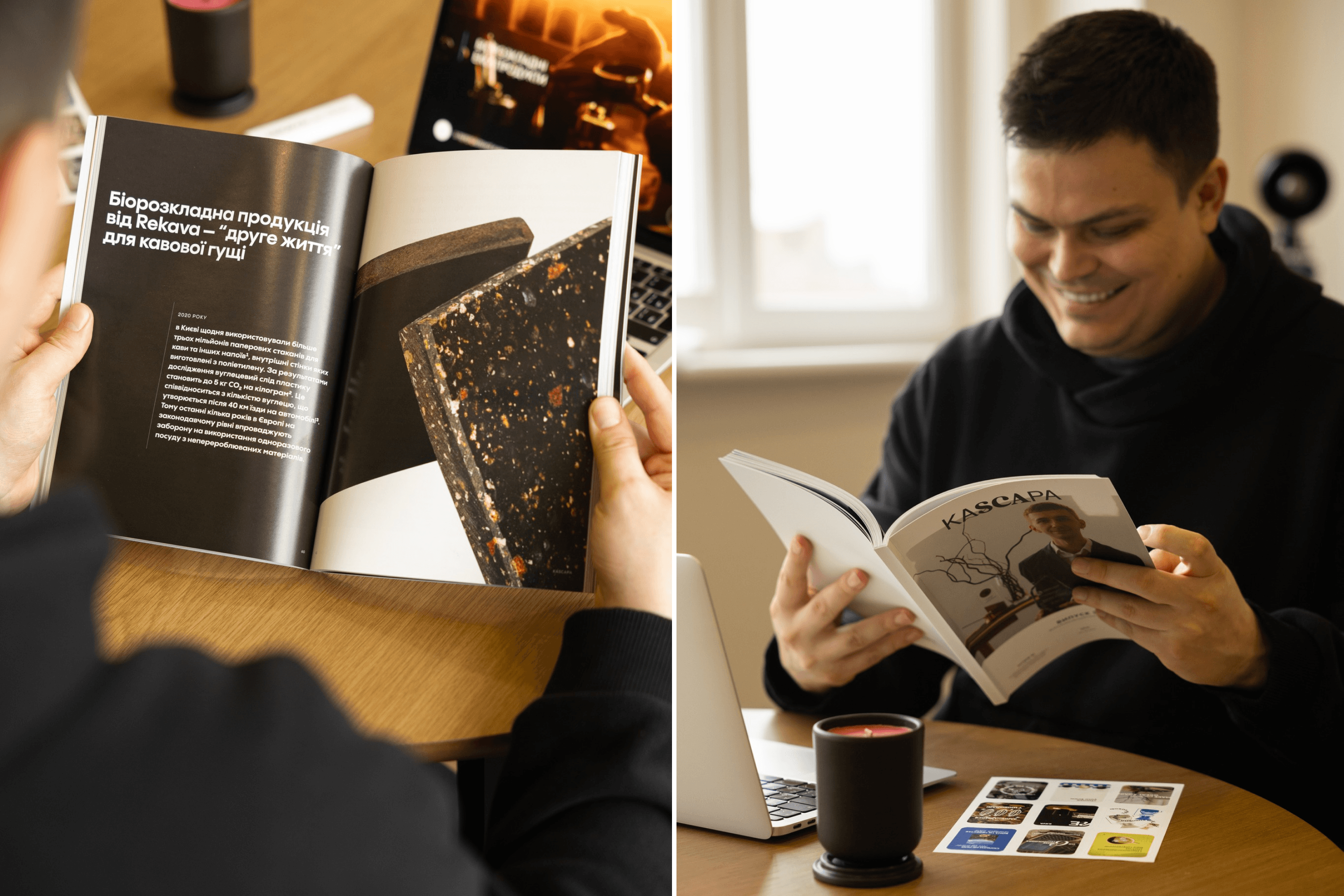

Ukrainian startup Rekava was founded in 2021 by economist Yurii Tustanovskyi and research engineer Dmytro Bidiuk, who developed a biodegradable material from used coffee grounds. It was first used for disposable cups, and later the range expanded to decorative tiles and candle holders. After Russia’s full-scale invasion of Ukraine, production had to be evacuated from Sumy to Lviv. There, the team began making scented candles from used coffee grounds, which quickly became popular in Germany, the UK, Poland, Japan, the U.S., and Italy. In 2025, this product line was sold to the Ukrainian brand Lviv Candle Manufactory. Today, Rekava is the only Ukrainian manufacturer whose coffee-waste products decompose in a few weeks. The company is preparing to launch its biodegradable tableware in the EU and U.S. markets.

YBBP journalist Roksana Rublevska spoke with Yurii Tustanovskyi about Rekava’s journey — from idea to international success.

Starting the business

Before founding Rekava, I worked in banking, insurance, and the public sector, including at the Ministry of Economy. When the government changed in 2019, I decided it was time to leave public service. I wanted to start my own venture that would make a positive impact. That’s when I came up with the idea of creating a biodegradable material that could replace single-use plastic. This need was felt especially acutely during the pandemic, as the use of disposable materials increased sharply.

I hold a PhD in Economics and have long been interested in circular economy models — production systems where waste can be reused. A key influence for me was Gunter Pauli’s work The Blue Economy. I realized that the idea of closed-loop systems could really work; the only thing needed was to assemble the right team. That’s when I reached out to Dmytro Bidiuk, a PhD in engineering and a research engineer specializing in bioplastics. Rekava officially began in 2020 with two co-founders.

Relocation and changes due to the war

At the time Russia launched its full-scale invasion of Ukraine, we were working on disposable tableware and preparing for mass production. To develop the project further, we needed money. After analyzing our options, we realized that without large-scale production, disposable tableware would not be profitable.

When the full-scale invasion began, our laboratory in Sumy ended up in the combat zone, and we had no access to it for a month. Once it became possible, we decided to relocate production. In April 2022, the Lviv Regional State Administration (LRSA) helped us find a contractor, move our operations, and partially cover the costs, as a government program supporting business relocation was in place at the time.

We spent about three months looking for a new space in Lviv. During that period, we operated out of a temporary location. Eventually, we found a suitable site through recommendations from the local business community. The current space includes 150 m² for production and 30 m² for office use.

During the full-scale war, we decided to focus on a niche product: candle containers. By summer 2022, we had launched a new line of decorative scented candles, using our own material as the base. This segment grew quickly but remained secondary to our main product. We created 25 scents dedicated to cities across Ukraine and began exporting to Germany, the UK, and Poland.

In 2022, the price of a scented candle in our biodegradable container was $23.75; by July 2025, it had risen to $30.00. This happened because the cost of raw materials also went up. Natural soy wax isn’t produced in Ukraine, so we purchase it from abroad. Similarly, high-quality fragrance oils are purchased from France. Currency fluctuations, logistics, and inflation also affected the price.

Working abroad

In January 2023, we took part in the major international CES exhibition in Las Vegas, appearing in the Ukrainian startup delegation’s booth. The event gave us direct access to leads, including B2B companies, and, because of our innovation, we received support from the media, including the BBC. After the exhibition, we launched an online candle store with international shipping and began working with partners in various countries. The most active buyers were distributors and corporate clients from the UK and Germany — for example, the German IT company SAP, which used our product as corporate merchandise. We also collaborated with well-known retailers in Berlin, such as Peek & Cloppenburg, and in Ukraine with TSUM Kyiv and BROCARD.

In addition to exhibiting at CES in Las Vegas, we presented Rekava at the professional Paris exhibitions Maison&Objet, where we were the only Ukrainian brand in the fragrances section in 2024, and Viva Technology in 2025.

Japanese companies first discovered us through B2B exhibitions. After that, the classic B2B process followed: months of negotiations, calls, and aligning on terms. Our Japanese partner Atlog initially bought a trial batch of candles and later increased the order volume eightfold. We offset logistics costs because our premium-class products sold successfully in Atlog’s cafés and coworking spaces.

This experience showed us that entering complex markets requires not only high-quality products, but also patience, a structured approach to negotiations, and a readiness to adapt logistics and pricing models to the specifics of each market.

Logistics

Within Ukraine, we have always used Nova Poshta. It is fast, reliable, and well organized. For international shipments, we used Ukrposhta for B2C orders through our website. Based on my personal experience, about 97% of parcels arrive on time — within 20–25 days to almost anywhere in the world. For B2B, the logistics are different: mostly truck transport to Poland. Sending parcels abroad with Nova Poshta is too expensive.

Our warehouses are located in Lviv, where we rent space, produce the goods, and ship them out. Previously, when we were working with candles, we rented a warehouse in Poland to speed up delivery to international clients. Now, there is no need for that.

Selling part of the business

In July 2025, we sold our candle division to Lviv Candle Manufactory and returned to a single-product focus: disposable biotableware.

Yes, the candle line had become successful — the products were in demand even in challenging international markets. But over time, it became clear that the project required either full concentration on candles or a return to biotableware. The candle business began to consume the resources, attention, and time that should have supported the development of our core product.

We now work in partnership with Lviv Candle Manufactory. Under our agreement, we no longer produce candles as a finished product, but we remain their sole supplier of candle vessels made from our biodegradable material.

Raw material suppliers

Two coffee drinks produce enough grounds for us to make one medium-sized disposable cup. We receive coffee grounds from various partners across Ukraine — not only cafés, but also large offices and corporations such as Raiffeisen Bank, SoftServe, and Wix. They gather the grounds at their location and then pass them on to us. This is done voluntarily and free of charge, with an understanding of the environmental value of this approach.

To understand the scale: an active café generates up to 10 kilograms of coffee waste per day, and corporate offices with hundreds of employees produce hundreds of kilograms per month. However, 98% of coffee grounds in Ukraine are still thrown away with general trash. For companies, working with us is part of their corporate ESG strategy, because once organic and non-organic waste are mixed, they can no longer be recycled.

We currently have 12 partner suppliers in Kyiv, Lutsk, and Lviv, each of whom provides us with up to 100 kilograms of coffee grounds per month, while about 30 more companies are waiting to join the partnership. We intentionally limit the volumes for now: our production capacity does not allow us to process more.

The most convenient way to store coffee waste is to freeze it. Otherwise, the grounds begin to mold. That’s why our partners store the grounds in freezers. They send them to us via Nova Poshta or by their own transport if they are in Lviv. The grounds are transported in regular bags or boxes, without the need for pressing. In the future, when production scales up, Rekava plans to move to a systematic collection model, where couriers would pick up the coffee grounds directly from cafés.

The open market niche

In Ukraine, Rekava has no direct competitors. We remain the only company producing disposable biotableware made from coffee waste that fully decomposes within a few weeks.

Globally, there are only a few examples of similar uses of coffee grounds, but all of them operate in completely different directions. For example, in Germany and Australia, there are brands that manufacture reusable cups made with added coffee grounds. They are stylish and dishwasher-safe, but their disposal is complicated: such products must be sent to special recycling facilities. Rekava, however, focuses on circularity in its purest form — the product is used and then fully decomposes, disappearing without a trace.

In Ukraine, there have only been a few isolated experiments using coffee grounds. For instance, in Ivano-Frankivsk, they tested producing heating pellets from coffee waste, but for reasons unknown to me, the project was suspended. There is also a brand with Ukrainian roots now operating in Bali, making eyeglass frames containing coffee grounds. However, that follows a different logic altogether — a designer, reusable product, not an ecological alternative to single-use plastic.

Money and Production

Rekava’s current production is the result of our own investments, which we are not ready to disclose at this stage, and several micro-grants totaling about $100,000. The equipment the company uses now is worth approximately $300,000. To fully scale and launch mass production with optimal cost efficiency, we need $1.6 million in investment. Previously, our business consisted of 60% B2B and 40% B2C. The B2C segment was active thanks to online sales. We have now turned it off on the website and are focusing on large contract sales and long-term partnerships.

Technologically, the process of producing biotableware is divided into two parts. The extraction block is similar to the equipment used at oil-processing plants. Its purpose is to prepare the coffee grounds for further processing. Automation would allow us to increase processing capacity from the current few hundred kilograms to one tonne per day. The second block is hydraulic pressing using press moulds.

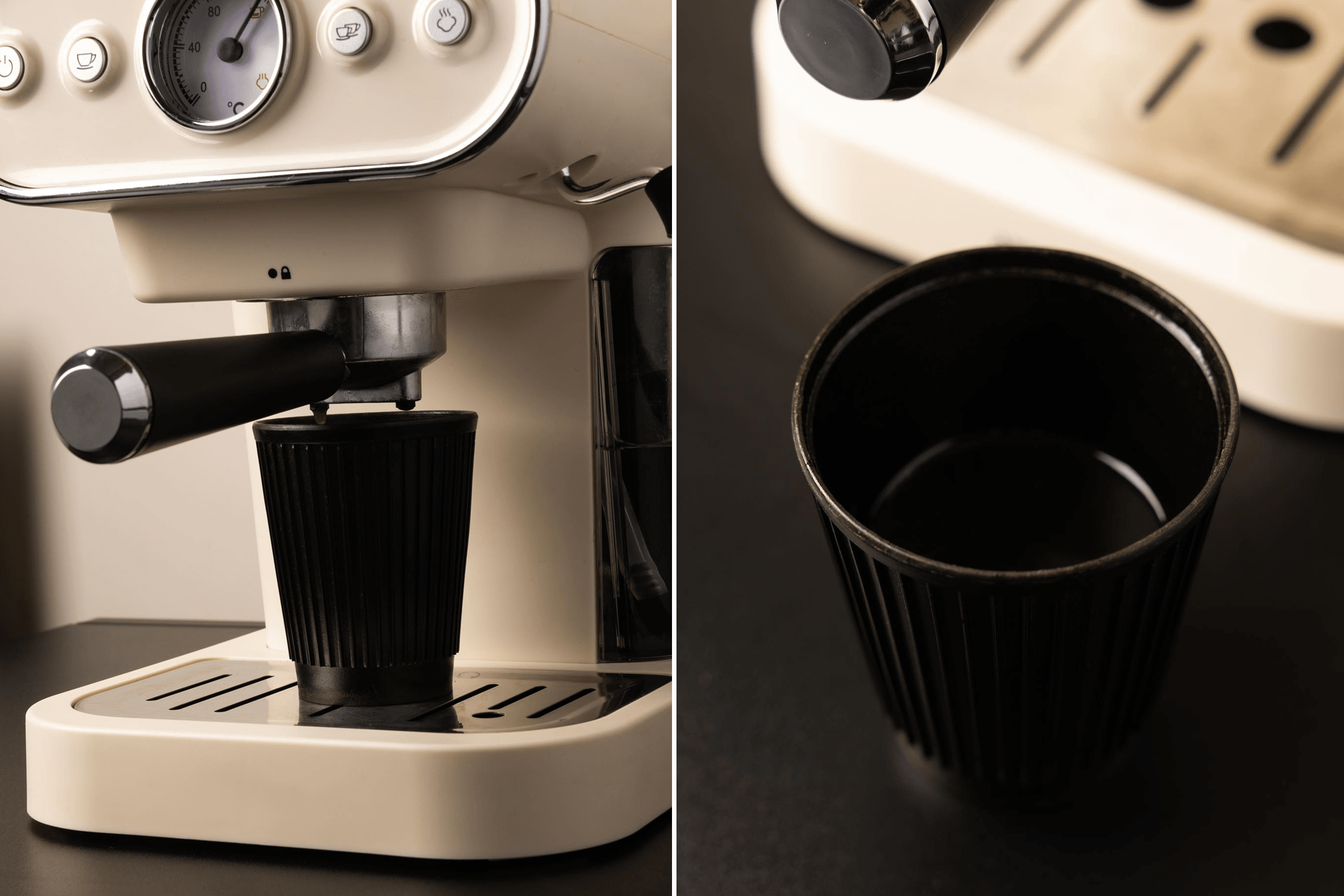

The first cup prototypes partially transferred the aroma and taste of coffee. This was unacceptable for us — we planned to eliminate the taste completely. Today, this issue has been fully resolved: when you pour water, tea, or any other drink into the cup, it does not alter the flavour. Of course, some consumer subjectivity remains, but with time and convenience, this will begin to fade.

We are now improving the cup’s design by adding vertical ribs that not only create a recognizable shape but also lower the surface temperature, making it comfortable to hold a hot drink without an additional cardboard sleeve. It may seem like a small detail, but decisions like this create a competitive advantage in the market. In California, for example, coffee buyers are often given two cups nested together to avoid burning their hands. But from a cost, sustainability, and logistics perspective, this is inefficient. We want to create a product that addresses these problems structurally.

Markets of interest

Our focus is Western Europe. There is a clear demand there for biodegradable tableware made from natural raw materials, and the EU Ecolabel system is in place. To reach this stage, we need to attract investment. That is why we are looking for a strategic partner or a venture fund. We need investment to upgrade equipment, expand the production line, and optimize logistics.

When it comes to tableware that touches food — plates, forks, cups — it’s important to understand that every country has its own regulations, and they differ. To enter a market, you must present product samples and then wait for a decision.

The situation in the United States is uncertain. A few months ago, the official White House account stated that disposable paper straws are “bad” because they become soggy, and that we should return to “normal plastic.” At first, I thought it was a meme or an AI-generated image, but no, it was real. So, our strategy is simple: the EU first, and later the U.S. selectively, in states where regulations align with our values, such as California.