Join UP! is a Ukrainian tour operator founded in 2010 by entrepreneur Yurii Alba, Within just five years, it became a leader in its market segment thanks to attractive prices on tours to the UAE, Turkey, Egypt, and Montenegro. Since 2018, the Ukrainian airline SkyUp has been a strategic partner of Join UP!. This allowed the company to lower prices and expand routes.

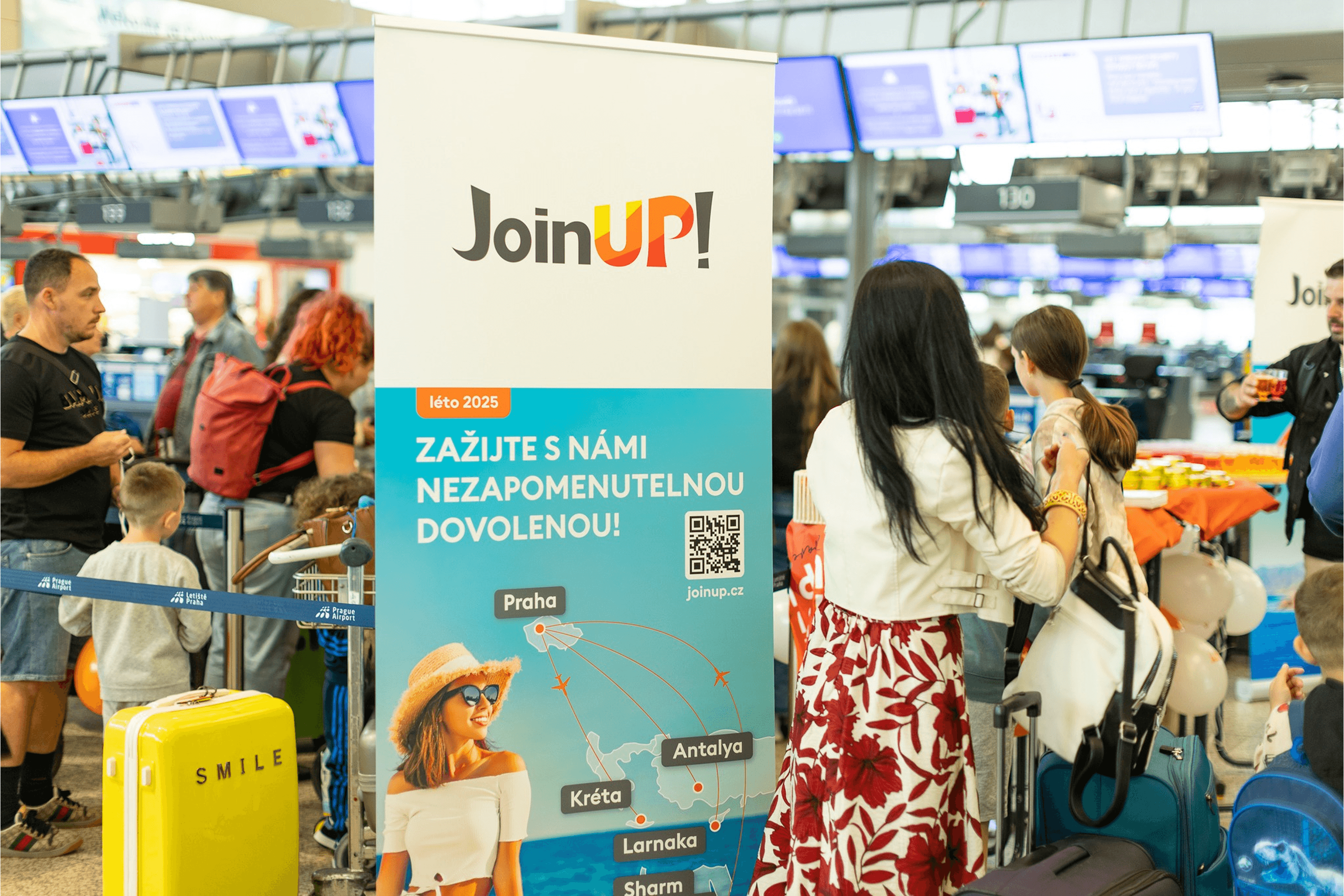

After the full-scale invasion, Join UP! focused on supporting existing bookings. Clients were given the option to change departure dates and cities, which helped preserve 60% of booked trips. In May 2022, the company entered the Baltic and Kazakhstani markets, and in 2024 it opened its first international franchise in Katowice, Poland. Today, Join UP! operates in Ukraine, Moldova, Kazakhstan, Romania, Poland, the Czech Republic, Latvia, Lithuania, and Estonia.

YBBP journalist Roksana Rublevska spoke with Sergii Kyrychenko, Join UP!’s Business Development Director, about strategies for rapid adaptation after the war, the use of artificial intelligence, effective customer engagement, and international expansion.

- Join UP! has more than 130 company-owned and franchised agencies, 33 of which opened after the full-scale invasion.

- The tour operator’s portfolio includes over 7,000 hotels available for booking, 250 of which have exclusive contracts with Join UP!.

- Over the past 15 years, 6.4 million travellers have used Join UP! ’s services.

- Join UP! ’s revenue in 2024 amounted to €430 million.

After the full-scale invasion began, reports emerged that Join UP! had suffered losses of $550 million. Is that true? And how did the company manage to recover from such a blow?

In fact, these were not direct losses, but an estimate of potential revenue that the company did not receive. We always plan a year in advance: the airline analyzes the number of passengers it can carry, while Join UP! determines the destinations and the number of tourists it can serve. Based on this, we calculate the average tourist spending — and this forecast is what forms the $550 million figure.

When did the company resume operations after February 24, 2022?

Join UP! suspended operations for about a month to return travellers and coordinate actions with partners. By April 2022, we had resumed the first flights from Chișinău, Rzeszów, Suceava, and Iași. About 60% of clients did not cancel their trips, only changing their departure city.

Did your strategy change after the full-scale war began?

We only accelerated its implementation. The company focused on markets we had already planned to enter before the war: in May 2022, we launched operations in the Baltic states and Kazakhstan. By August 2022, Join UP! obtained a license in Romania, and in November, in Poland — the two most populous countries in the region with strong outbound tourism potential. By 2026, we plan to enter the Slovakian and Hungarian markets.

What is required to obtain a tour operator license in Europe? How much does it cost, for example, in Romania?

Companies must comply with both European and local tourism legislation. The main requirement is to guarantee protection for tourists in case the tour operator goes bankrupt. This can be done through insurance, holding assets, or freezing funds in an account. Each tour operator declares the planned number of tourists and the average spending, and the regulator determines the guarantee amount required for the license. License costs vary depending on the country and business volume. For example, in Romania, obtaining a license required freezing €100,000 in an account. The insurance process itself is complex, as insurers are cautious with new players due to past bankruptcies. In Romania, the minimum license amount is €5,000, but it increases depending on the declared number of tourists.

Regarding Poland: I cannot comment on the amounts, because there, in addition to financial guarantees, owners must provide additional proof of operations. The system protects tourists and prevents situations where tour operators go bankrupt and disappear, as happened in the past.

Is this insurance applied if flights or a tourist’s trip are canceled?

No, the insurance only applies if the tour operator goes bankrupt and disappears. The tourist then contacts the insurance company or bank to receive compensation.

Does Join UP! involve external investors?

We finance the company’s development entirely with our own resources. This allows us to remain flexible, avoid dependence on investors, and make decisions based on real capabilities. We carefully weigh every step: investing in team development, improving processes, and expanding the business. For example, in 2022, we established a commercial and revenue team in Turkey. This team works daily with DMC companies and hotels to secure the best conditions for our tourists. This approach allows us to grow steadily and without unnecessary risks.

You mentioned reorganizing the company’s structure. Can you give a specific example of what you changed?

Expanding into European markets showed that simply increasing staff wasn’t enough — deeper expertise was needed. We designated regional directors, each responsible for a specific area: Ukraine, Moldova, and Kazakhstan; the Baltics and Poland; and Romania. I oversee the new markets — the Czech Republic, Slovakia, and soon Hungary. Local directors understand their markets better, make decisions faster, and build direct relationships with partners. This approach speeds up management and allows the central team to focus on product and service, scaling the business without losing control.

So, do regional directors monitor the quality standards of Join UP! offices and franchises abroad?

Yes. Each market has a regional director, an international specialist responsible not only for opening new locations but also for maintaining existing ones to ensure they meet high service standards. There’s also a team that trains sales staff and managers in each office. Our B2C department monitors sales performance daily, while the marketing team handles customer acquisition.

Why was Katowice, Poland, chosen as the location for Join UP! ’s first international franchise?

The first Join UP! offline office in Katowice opened thanks to one of our Ukrainian agents who had been working with us for a long time. After relocating with his family, he had been working online but wanted a physical office under the Join UP! brand. We developed a unique agency concept for Europe with a modern design, which received strong feedback from Ukrainian and local partners alike. After agreeing on terms and signing the contract, our first international franchise was born.

Within a few weeks, a second franchise opened in Krosno, Poland, a region with a large Ukrainian diaspora. This initiative came from a local agent with Polish roots, one of the leading players in his region. We focus on local partners who understand their markets and can respond quickly to demand.

Do you see this model as key to entering new markets?

Absolutely. We see significant interest from Ukrainian agents already established in European cities, who understand the needs of local clients. For example, we are opening our own office in Timișoara, Romania, this August, recently launched another location in Kaunas, Lithuania, and just last week opened in Prague, Czech Republic.

You don’t open multiple offices at once, but wait for each one to become profitable?

Exactly. In every country, opening a new location is an investment. We agreed internally: we make one location profitable first, and only then open the next one.

How long does it usually take for a shop to become profitable, and how much does it cost to open one?

The cost of opening a shop ranges from $25,000 to $40,000, depending on the location, city, and country. For example, our regional director for the Baltics shared in our internal chat that the first location opened and within two hours had three orders. If the location has good foot traffic and the offer is strong, results come quickly. On average, it takes 3–5 months to reach stable profitability, though this period can be shorter in the summer.

What financial models do you offer franchisees? Is it more about image or real profit?

We are a big-volume-oriented tour operator. Franchisees earn commissions, bonuses, and clear sales targets, which vary depending on the size of the city. But the model benefits everyone: they see that the brand works — marketing brings customers, training produces effective sales staff, and bonuses provide extra motivation. If a franchisee meets the plan, they earn more; if they exceed it, they receive additional bonuses. It’s not just about control — it’s a partnership.

You brought in 730,000 tourists in 2024, despite a challenging period. What helped you reach that volume?

We didn’t just sell tours — we built a complete ecosystem. Analytics allowed us to forecast demand by season and even specific routes. Automated CRM systems let us engage with each client personally, while targeted campaigns on social media and search engines helped us reach people already ready to travel. But the real advantage comes from our offline sales points. They give customers a sense of reliability and trust that you don’t always get with purely digital models. This blend of technology and human contact is what enabled us to reach 730,000 tourists, even when the market was shrinking.

You mentioned that in Poland, the Czech Republic, and other countries, tours are actively purchased not only by Ukrainians but also by locals. How important is this for your business?

It’s crucial. Cultivating the local traveler is one of our strategic priorities. We tailor our products to each market and collaborate with local agencies and OTAs. This approach allows us not just to sell tours, but to become an integral part of each country’s tourism ecosystem.

How do you personally adjust analytics to meet the challenges of today’s geopolitical turbulence? After all, the pandemic, war, and sanctions have had a major impact on tourist behavior.

Traditional forecasting models don’t work in such conditions. That’s why we supplement official statistics from local markets with real-time monitoring via Google Analytics. We see early search queries, track interest in destinations in real time, and immediately adjust products, discounts, and ad campaigns. We also analyze average spending, airline popularity, and seasonality, while applying proprietary models that take geopolitical context into account. When worrying news arises in a region, we quickly offer alternative options to avoid losing clients.

Have you started integrating artificial intelligence into your operations?

We also create dynamic packaging. This technology pulls together flights, accommodations, transfers, and extra services from different sources in real time and combines them into a single tour package for the client. The system automatically selects the best options for specific dates and budgets. Essentially, it handles the routine work agents used to do manually. This allows us to create personalized offers without being limited by pre-booked quotas. It’s a whole new level of service — faster, more accurate, and completely personalized.

For example, in the past, tourists using the “Tour Search” section had to manually fill in dozens of fields, from country and hotel category to meal plans and group composition. They then had to compare hundreds of options over several hours. Now, we have an AI-based search. The traveler only needs to enter basic parameters such as departure city, dates, budget, and number of travelers, and can even add free-form preferences: “We’re traveling with kids, want a sandy beach, a hotel with a water park, in June, destination is flexible.” The system analyzes the request and delivers the most relevant options.

Additionally, we’ve developed our own content management system, which categorizes every hotel using hundreds of filters, from the availability of a water park to snorkeling opportunities near the shore. This allows the AI not just to eliminate irrelevant options but to find the perfect tour tailored to the client’s exact expectations. We maintain a database of about 7,000 hotels, and the AI automatically translates descriptions into other languagesIf we enter the Hungarian market tomorrow, we wouldn’t need a year for manual translation; the system can handle it in just a few days.

Don’t you feel threatened by the trend of travelers increasingly booking their own flights and accommodations? I have to admit, I’ve never used a tour operator myself…

You’re not alone (smiles). Self-booking has indeed become easier and more accessible. But our strength isn’t in selling tickets — we provide clients with complete solutions, from flights to accommodations, with price guarantees and reliable support. Our advantage lies in local expertise and personalized service. We offer in-person support, know the ins and outs of each destination, and can quickly resolve any issues. So instead of spending hours planning, clients get a ready-made tour and the confidence that their trip will be stress-free.

What’s your survival strategy in the era of artificial intelligence and the rise of DIY tourism?

Scale and the best price. We work with large volumes, which allows us to negotiate the most favorable terms with hotels. Four years ago, we approached them as a tour operator from Ukraine and Moldova. Today, we’re active in 10 markets. In five to seven years, some of our key targets are the UK and Germany. If you operate in the mass market, for example in Turkey or Egypt, and have those markets in your portfolio, you get completely different rates — sometimes 10–20% below standard market prices.

In Germany and the UK, will you target local tourists or the Ukrainian diaspora?

The focus will be roughly 70% on local travelers and about 30% on Ukrainians and other migrants already living there. But to win over that 70% of Germans will take at least ten years. They tend to be conservative when choosing tour operators and are unlikely to switch their favorites quickly.

So what will help you convince such a traveler?

Honesty and scale. We plan to enter the market with strong products, competitive prices, and local support. I’m afraid I can’t share all the details. On top of that, our investments in technology allow us to make the service as simple and personalized as possible. A German or British traveler may not know Join UP! today, but if they see transparent pricing, an easy booking process, and a service without surprises — that’s the first step toward loyalty.

If an investor wants to operate under the Join UP! brand, what do they need?

We already have a tried-and-tested franchising model. The investor needs to have a company with a tour operator license in their country and experience in the travel industry — or a strong team ready to take it on. We provide full support: the IT platform, marketing materials, staff training, and access to our exclusive contracts with hotels and airlines. Essentially, the partner receives a ready-made business model, enabling a rapid launch under a well-known brand while adapting it to their local market.