YBBP journalist Roksana Rublevska spoke with Mr. Pops’ co-founder, Yevheniia Antipova, about how the brand has changed the way we think about ice cream over the past 10 years, continues manufacturing in Ukraine while expanding internationally.

When the war began in Ukraine in 2014, entrepreneur Yevheniia Antipova, like millions of others, were hit hard not only with emotional shock but also harsh economic realities. They began searching for new opportunities. That’s when she got an unexpected idea from a friend — introducing a type of fruit ice cream popular in Latin America. It was La Paleta — a fruit-based frozen treat on a stick, known in the U.S. as a popsicle.

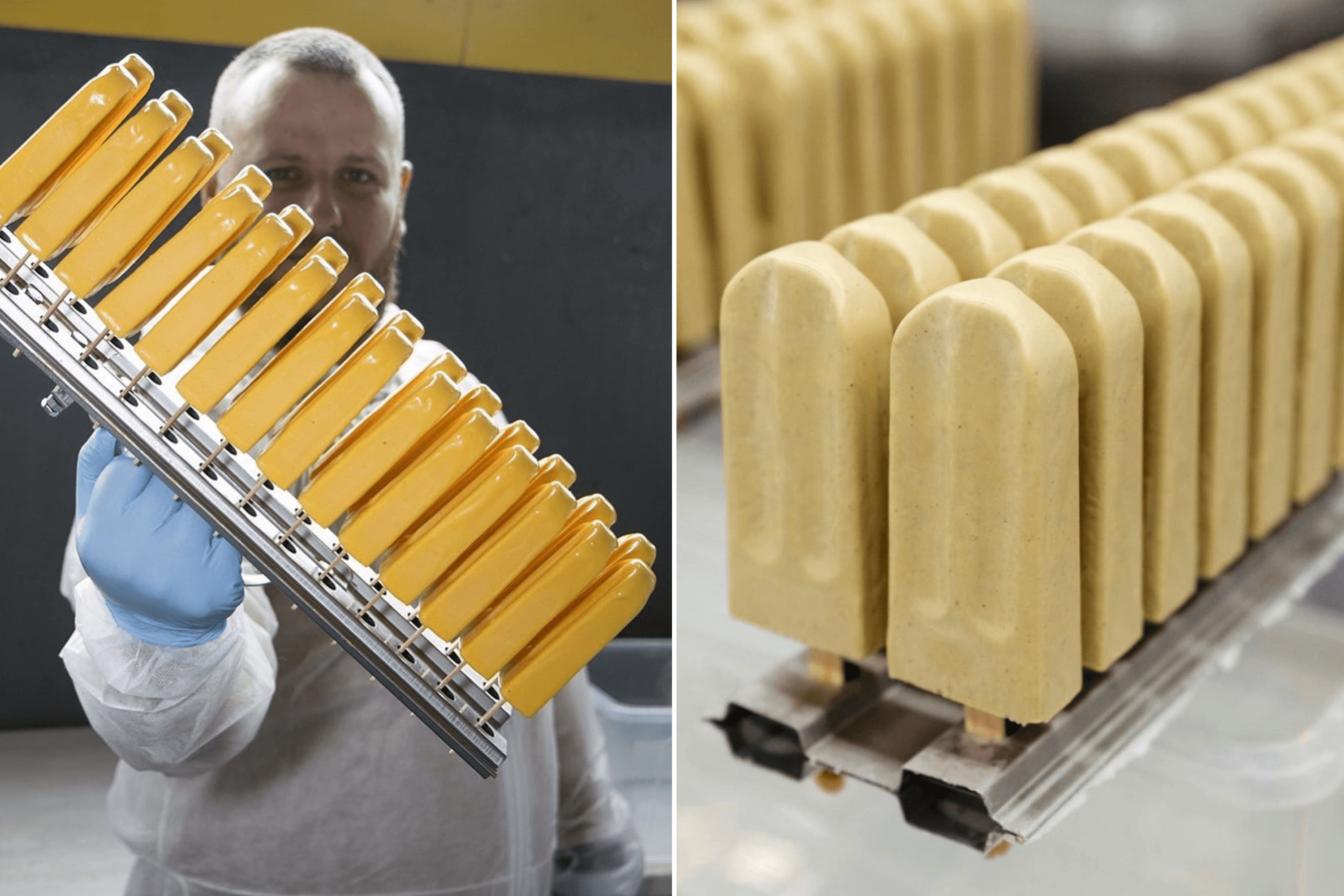

With no background in the food industry, no thorough market research or business plans, she decided to take a risk. In 2015, Mr. Pops was born. Their first business model was as simple as it gets: they made ice cream at home using plastic moulds ordered on AliExpress and sold it from a bike cart along the embankment in Dnipro on hot summer evenings. It didn’t take long to grab attention, not just for the product, but for the unconventionally quirky way it was sold.

Targeting hipsters at first proved to be a smart move, but the true fans of the product turned out to be gastronomic hedonists and older generations looking for rich, natural fruit flavours without additives. In winter 2018, Mr. Pops received HACCP certification, a major step up in quality and food safety. Soon, cafés and gourmet spots across Ukraine were proudly serving their popsicles.

In May 2023, Mr. Pops opened production in Poland and stepped into the EU market. That summer, Mr. Pops' popsicles appeared in Warsaw, followed by Wrocław and Kraków. The Polish market gave the brand room to experiment, introducing unique new flavours and even launching an entirely new product: the popular Japanese mochi dessert.

Today, you can find Mr. Pops in 200 locations across Ukraine (half of them in Kyiv) and 64 locations across Europe. The brand plans to launch Mr. Pops in the United States, Canada, and the Middle East in the medium-term perspective.

You launched production in Poland in May 2023, and by August, Mr. Pops was already on shelves in Warsaw. Why was Poland your first step on the road to international expansion?

For us, it was a logical and strategically sound first step. We analysed the EU markets and saw Poland as one of the most promising places to start. The Polish economy has shown steady growth for decades, and the country is among the EU leaders in terms of development. On top of that, Polish consumers are culturally quite close to Ukrainians, which makes adapting the product and communication much easier.

Were there any challenges during the launch of production in Warsaw?

One of our first challenges was finding a space that met all our requirements, from hygiene standards and storage conditions to temperature control and certification. In the end, we opted for a food coworking setup — a shared facility where several food producers operate side by side. It includes communal areas like kitchens, washrooms, storage rooms, and freezers, but each company still has its designated production space. This allowed us to optimize logistics and administrative costs while maintaining a high product quality.

Would you say Polish consumers are different from Ukrainian ones?

Absolutely. In Ukraine, people are open to new things, quick to respond to unusual formats, and ready to experiment. Polish consumers, by contrast, are more cautious. They tend to choose local brands and familiar flavours, so a foreign product like ours takes time to gain trust.

When we launched, we expected the same fast-paced Kyiv-style response — instant excitement, lots of enthusiasm. But Polish consumers took their time observing, analysing, and testing. It was a slower start, but it taught us to be patient. Also, €4.50 for an ice cream seemed expensive for many at first. But that changed the moment they had their first taste. It took nearly a year to break through. Today, Mr. Pops is available in 50 locations across Poland, in shops and cafés, and demand is growing. We’re now adding two new locations every week.

You first launched in Warsaw. How did you choose which cities to expand to?

We considered several factors: logistics, market potential, local demand, and whether partners were ready to collaborate. Warsaw, Wrocław, and Kraków were our starting points. Next year, we’re aiming to add Poznań and Gdańsk.

You currently have a team of 12 at your Ukrainian facility in Dnipro. How many people work at your European facility in Warsaw, and are they all Ukrainians?

So far, it’s a team of six, Ukrainians and Belarusians.

Are you planning to open local production facilities in other countries and expand your team to dozens?

Not for now. Our Warsaw facility allows us to serve the entire European market efficiently. Looking ahead, we’re interested in the U.S., Canada, and the Middle East — promising markets with strong demand for our product. We also just launched sales at three locations in Nice. We plan to expand the team as our sales and production volumes grow.

In summer 2024, you entered the German market. Why Germany?

Germany made sense, it’s logistically convenient for us. We started with pop-ups, introducing Mr. Pops at weekend gastro markets for six months. Then, a partner in Berlin told us that there was interest in growing the Mr. Pops brand in Germany. That was a clear signal for us — the product was resonating. Berlin felt like the perfect place to start: a city that welcomes new ideas and vibrant food experiences. We currently have two locations there, with a few more in the pipeline, in the negotiation or renovation phase of upcoming launches. Each popsicle sells for €6.

Is the German market more challenging than the Polish one?

Yes, the competition here is stronger. Berlin may be open to innovation, but German consumers are used to top-notch quality and are very selective in what they buy. The certification process and food safety compliance requirements are more demanding.

We’re not technically importing into Germany since sales within the EU aren’t classified as imports. HACCP compliance is mandatory across all Eurozone countries. In Europe, there’s a strong focus on product labelling — ingredients, allergens, country of origin, and nutritional value must all be clearly stated.

That brings me to a question about quality. With ongoing missile strikes in Ukraine, how does the changing environmental situation affect fruit and berry quality? And does it complicate supplier certification?

Of course, the war affects the environment, inevitably impacting the agricultural sector. However, we work exclusively with suppliers who have all the required documentation from official regulatory authorities, ensuring products meet strict sanitary, environmental, and safety standards before they even reach us.

So your technologists don’t additionally test the raw ingredients?

No, we work with certified suppliers whose ingredients are tested by authorized labs that confirm product safety. For us, the key is to work only with trusted producers who go through regular audits.

Is it more profitable to sell in Ukraine, where you already have 200 locations, or abroad?

It’s less about geography and more about having an efficient business model. We can be profitable both in Ukraine and in Europe as long as our operations are efficient. Our margins are stable across every market. However, costs in Europe are definitely higher, everything from logistics and rent to wages and certification. That’s why we have to price the product higher, but the profit margin stays consistent. We simply adapt pricing to each specific market.

How do international customers respond to your product?

Generally, very positively. People are open to trying something new. But there is a catch — in European culture, a popsicle is usually seen as a mass-market item: simple, with a long shelf life and a low price. So when we offer a handcrafted, beautifully designed product with bold flavour, it’s a new experience for many. That’s our challenge — not just to spark interest, but to explain why this product is worth their attention.

So is it also about educating the customer?

Exactly. For example, gelato is a format that Europeans know well. In many countries, it’s part of the local food culture. We offer popsicles, but with the same care for ingredients, technique, and quality as premium gelato. We’re creating a new kind of experience and want the customer to recognize and appreciate the difference.

How much did it cost you to enter the European market?

We’re not going to share exact numbers, but we’ll be honest — the cost was significantly higher than we had initially expected. Our margins are fairly standard for the HoReCa sector, similar to what you’d see in cafés or restaurants — roughly one-third of the final retail price. We expect that by the end of this summer, our European production will no longer require additional investment. For now, it’s our Ukrainian sales that are keeping us profitable.

How much of your investment went into marketing and certification?

These weren’t our biggest expenses — together, marketing and certification made up about 10% of the budget. We took a lean approach, focusing on organic growth and clear, targeted brand positioning.

What’s been the biggest financial challenge so far?

Logistics — especially in the frozen segment, where you need to keep the temperature consistently at –20°C. In Ukraine, we’ve built a strong network of partners who offer great terms. But in the EU, it’s much more complicated. Micro-logistics for frozen goods is still a tough nut to crack. We’re actively searching for reliable partners who can handle this very specific niche.

How do you avoid falling into the trap of “Ukrainian product only for Ukrainians abroad”?

That hasn’t really been a problem for us. We’re proud of where we come from — and always will be. But at the same time, we’re building a modern, international brand that’s focused on the European consumer.

There’s a growing demand for vegan products, with conscious consumption being trendy. How hard is it to make vegan ice cream without compromising on taste?

It’s definitely a challenge. It’s tough to recreate the smooth flavour from dairy fat, without a classic creamy base. It all comes down to texture and balance, which means carefully choosing plant-based components and refining the recipe until it’s just right. Despite the difficulty, we already have a successful vegan product — mango dipped in chocolate. It sells well in Poland, and we’re seeing growing interest in this category.

When creating new flavours, do you analyse trends or is it intuitive? And how often do you launch something new? Isn’t there a risk that customers stick to familiar options?

It starts with intuition — that’s behind more than half of our decisions. We’ve developed about 20 flavours over the last 10 years, most of which we’ve perfected over time. We introduce new flavours once or twice a season, depending on ingredient availability, logistics, and that inner feeling of “this one will work.”

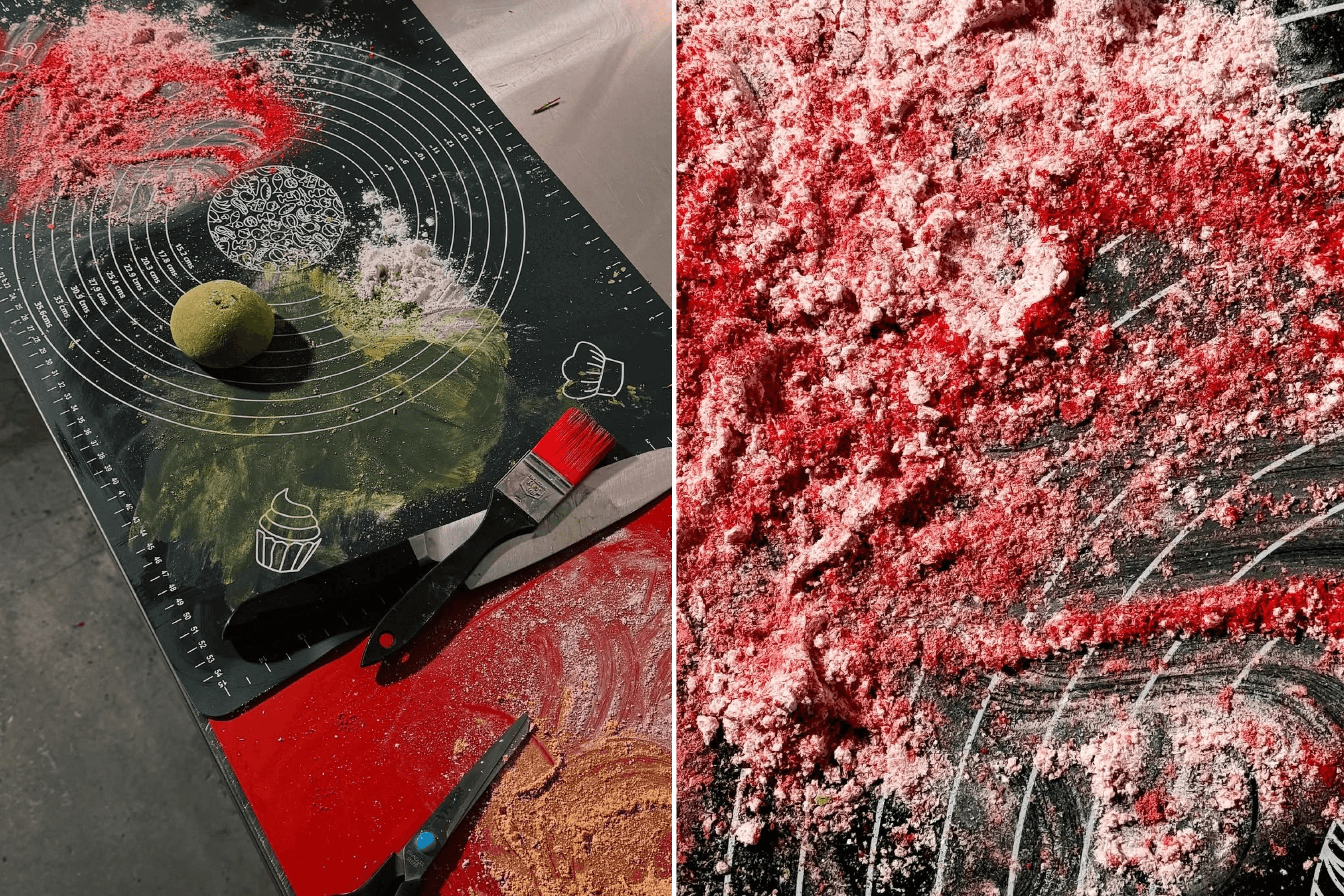

Of course, we keep an eye on food trends. Matcha, for example, was gaining popularity so quickly that we decided to give it a shot. But before taking it to the market, we tested over 30 matcha variations and chose the one that hit the perfect balance between bold taste and ingredient recognition. Yes, most customers stick with the classics — vanilla, pistachio, chocolate. But part of our mission is to introduce people to new flavour experiences. Toffee, lavender — the choices which help expand the idea of what ice cream can be.

Which flavour has been your biggest hit — and did you know it would be?

As one of our partners loves to say, “All flavours are like children — you can’t pick a favourite.” And it sums it up well. Every Mr. Pops flavour has its backstory, energy, and loyal audience. Some guests return again and again for pistachio. Others won’t go for anything but classic raspberry. We don’t focus on individual “hits.” Our strength lies in the flavour range — it works like a well-balanced ensemble. And the numbers back that up: from month to month, sales are spread almost evenly.

You’ve recently added the Japanese dessert mochi to your lineup. Why mochi?

Ice cream is a seasonal product, and we’ve been looking for something to help us stay consistent through winter. Mochi is a frozen dessert, and it’s a great fit — it can be enjoyed all year round.

Was it difficult to adapt mochi to your production process?

Yes — we took it seriously. We spent nine months experimenting with technology, raw ingredients, and textures. We studied the history and original recipe. Now, we offer a variation of daifuku, a Japanese mochi with filling, made with natural ingredients and free of preservatives or artificial colouring.

Did consumers accept it?

Most people only know mochi from frozen supermarket versions, and many didn’t return to it after their first try. This creates a certain bias. We’re trying to shift that perception by offering a truly balanced flavour, one that people will want to come back to.

Is mochi good for your B2B partners?

Mochi is a very convenient format for partners — it’s easy to store, quick to serve, and sells well even in smaller cafés or shops.

Has the full-scale war disrupted your logistics or supply chain?

The war has certainly changed the rules of the game. We faced power outages, life-threatening risks, and the forced relocation of a part of our team. But even with all that, we adapted and restructured our logistics to keep moving forward. We’re still able to find certain raw ingredients in Ukraine that we couldn’t source across the EU, like strawberries. In Poland, they’re everywhere, but their flavour in ice cream just doesn’t deliver the same intensity and aroma as Ukrainian strawberries, which was a bit of an eye-opener for us.

You once mentioned that during the first year of the full-scale war, you lost access to strawberries, which you used to source exclusively from farms in the Kherson region. You didn’t want to swap them out for other berries, so you waited until you could bring that flavour back. Are there any ingredients currently in short supply?

Right now, the only ingredient we’re really struggling with is mango. Our longtime supplier stopped operations because of the war and shifted to other markets. Surprisingly, we haven’t been able to find a good replacement even within the EU. That’s why, starting next year, we’ll be importing mango directly from India, centrally, for both our Ukrainian and Polish production facilities.

Can you share your production figures for 2024?

We don’t publish exact numbers — that’s part of our internal policy and protected by NDAs. But to give you a sense of scale: in 2024, our production volume in Ukraine was roughly four times greater than in Poland.

Is it because the Polish facility is still new?

Yes, it was launched recently, so it’s not yet operating at full capacity. That said, we plan to significantly reduce that gap — by at least half — by the end of 2025. Growth in both the European and Ukrainian segments is equally important to us.

What makes you confident in such ambitious growth forecasts?

Primarily, is how quickly we’re gaining traction in new markets. Even this season, we plan to reach 100 active B2B locations across the EU. These are partners in the final stages of onboarding. We’ve built strong, reliable relationships. We’ve intentionally focused on smart, sustainable growth rather than fast, flashy expansion.

Your brand is associated with minimalism. Has the packaging evolved since you started?

Actually, no. We’ve always stuck with our clean, simple packaging. It has become a part of our brand identity. That transparent wrapper is like our brand’s DNA. It reflects not just our aesthetic, but also our values — transparency in our processes, in our relationships with partners, and in the product itself.

Has anything changed visually over time?

We did refresh the branding — the logo’s been updated. But the core concept has remained unchanged since 2015. Transparent packaging with the logo has always been a key principle, and we’ve never deviated from it.

Are European consumers ever surprised by that choice?

Both in Ukraine and across Europe, people often ask, “Why not go with a bright, colourful wrapper?” But we’ve made a deliberate choice to stick to our minimalist approach.

Why?

Because it’s not a design choice, it’s a philosophy. We promise transparency in our recipes, in distribution, and communication. The packaging reflects that promise. If you can’t see the product, how can you know what you’re really getting? And ice cream is a delicate product — it’s easily deformed, especially if not stored properly. Transparent packaging is also a form of quality control.

Ice cream doesn’t have a long shelf life. How do you manage leftovers?

Our ice cream’s shelf life is four months from the production date. We send samples to a lab for testing each year, and some flavours have even passed six-month stability tests. But we’re honest with ourselves and our customers: after four months, the texture starts to change. And for us, quality isn’t something we compromise on.

What happens to ice cream that doesn’t sell before its expiry date?

At the end of the season, we swap out the old stock for fresh product. We have a few solutions to handle leftovers: some fruit-based flavours are passed on to a partner who uses them for feeding farm animals, and the rest is sent to a company that specializes in responsibly disposing of food products.

Are the write-offs significant?

It depends. If we get our end-of-season forecasts wrong, we can end up with as much as 7% in unsold stock. But we’re constantly working to bring that number down. There’s a bit of a paradox — when only a few items are left in the display freezer, they sell poorly because they look like leftovers. A fully stocked display, on the other hand, gives the impression of freshness and variety.

Do you try to reduce write-offs by offering discounts?

No. We’ve taken a clear position: a quality product shouldn’t need to go on sale. The only exception we make is at festivals or events, where we offer samples for people to try. But in regular retail, we don’t do discounts. Our focus isn’t on selling quickly, it’s on preserving the value of the product.

Where do you see Mr. Pops in the next five years? As a global brand or more of a niche network?

Our ambition is to lead the craft ice cream segment in the European Union. We’ve already laid a strong foundation: stable production, a strong product, growing brand recognition, and successful entries into new markets. Europe is our priority right now. But our vision is broader. In the medium term, we’re considering launching in the U.S. and the Middle East. Our strategy already includes potential locations — Miami and Dubai, both multicultural cities with high demand for quality food experiences. We’re already starting to get inquiries from both. That kind of expansion, however, requires building infrastructure from scratch and time, which is always in short supply. That’s why, for now, our focus remains on refining the European model.

Are you looking for investors to support your growth?

We’re open to strategic partnerships. If an investor can help us grow faster and stronger, not just a funds contribution, we’re absolutely open to sitting down at the table. For the scale we’re aiming for, we’re talking seven-figure investments.