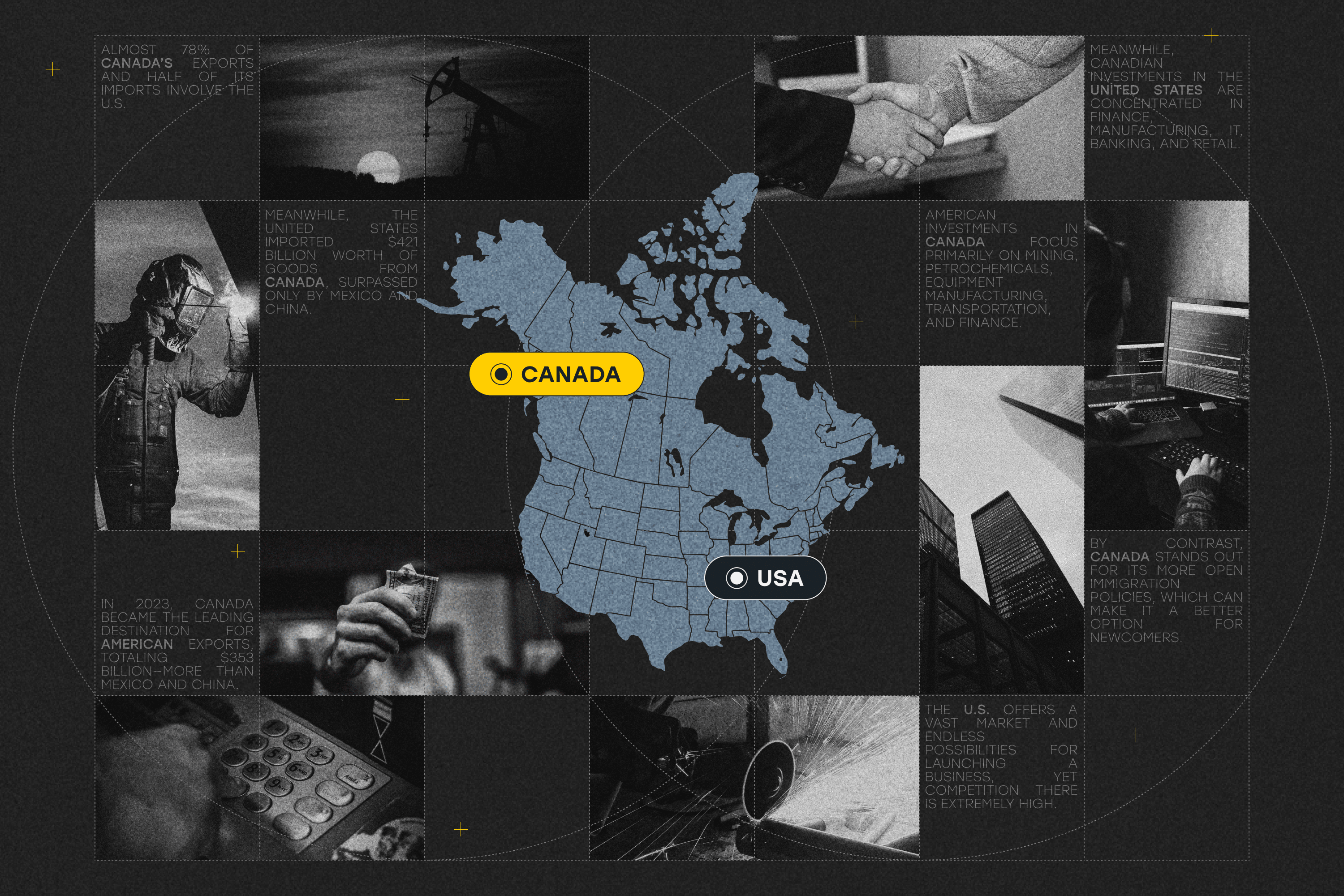

In 2023, Canada became the leading destination for American exports, totaling $353 billion—more than Mexico ($323 billion) and China ($148 billion). Meanwhile, the United States imported $421 billion worth of goods from Canada, surpassed only by Mexico ($476 billion) and China ($427 billion). Almost 78% of Canada’s exports and half of its imports involve the U.S.

American investments in Canada focus primarily on mining, petrochemicals, equipment manufacturing, transportation, and finance. Meanwhile, Canadian investments in the United States are concentrated in finance, manufacturing, IT, banking, and retail.

The U.S. offers a vast market and endless possibilities for launching a business, yet competition there is extremely high. By contrast, Canada stands out for its more open immigration policies, which can make it a better option for newcomers. So which of these countries is ultimately more profitable for Ukrainians looking to start a business?

CANADA: Why Doing Business is Beneficial Here

Ease of starting a business

Canada provides simpler procedures for registering a business, which is especially helpful for first-timers. While the United States ranks 6th in the “Doing Business” index and Canada 23rd, Canada excels at making the process accessible to small enterprises.

Taxes

It’s often assumed that Canada has more favourable tax conditions for business, but this really depends on which region of each country you compare.

- The federal corporate tax in Canada is 15%. With provincial rates of 11.5% to 16%, the total can run from 26.5% to 31%, averaging approximately 28.25%.

- In the U.S., the federal rate is 21%. Once you add state taxes (ranging from 0% to 12%), the combined rate could be anywhere from 21% to 33%. On average, it’s about 27%.

For sales tax, Canada has a 5% federal Goods and Services Tax (GST), plus either a provincial (PST) or harmonized (HST) tax. In the U.S., sales tax depends on the state and can range from 0% to over 9%.

Access to international markets

Canada has free trade agreements with more than 50 countries, including the EU (CETA) and the Pacific region (CPTPP). As a result, Canadian businesses gain entry to markets with more than 1.5 billion consumers, offering a competitive edge.

Immigration support

Canada actively attracts entrepreneurs through programs such as the Start-Up Visa, which enables participants to obtain permanent residency if they have support from designated organizations. This creates favourable conditions for foreign business owners.

Skilled workforce

Canada is renowned for having one of the world’s top education systems. According to the OECD, it ranks among the leaders in higher-education attainment, ensuring businesses have access to well-qualified professionals.

THE UNITED STATES: An Ideal Business Environment

Market size and economic strength

The U.S. has the world’s largest economy, with a GDP of roughly $24.8 trillion (2021). Its population exceeds 333 million (2022), providing an enormous consumer market. For entrepreneurs planning to scale and capture a wide audience, it’s extremely attractive. In contrast, Canada’s population of about 39.5 million (2023) makes its market notably smaller.

Innovation ecosystem and access to funding

The U.S. is a global leader in innovation, home to tech giants like Apple, Google, Microsoft, Amazon, and Meta (Facebook). These companies not only set trends but also heavily invest in R&D, spurring ongoing technological development.

Well-known startup hubs, including Silicon Valley in California and Austin in Texas, offer dynamic entrepreneurial cultures, access to venture capital, angel investors, and tech expertise. In 2022, the U.S. held second place in the Global Innovation Index, emphasizing its leadership in technology and infrastructure.

Broad access to capital

American entrepreneurs benefit from diverse funding options — venture capital funds, government grants, bank loans, and angel investors — making it easier to secure the resources needed for business launch and expansion. The U.S. outperforms every other country in terms of total venture capital investment into startups.

Business-friendly environment

The U.S. boasts developed infrastructure enabling efficient logistics, manufacturing, and services. Many states strive to streamline regulations, reduce the tax burden, and create welcoming conditions for business owners.

Scalability and global influence

An expansive domestic market helps companies grow quickly, often translating into higher profits. At the same time, American firms enjoy a strong reputation globally, which eases entry into international markets.

Tax incentives and asset protection

Various states offer special programs for businesses, such as tax breaks, grants, and subsidies. Registering a company in the U.S. also typically protects the personal assets of business owners against corporate debts, mitigating risks for entrepreneurs.

Tech development and Artificial Intelligence

The U.S. actively incorporates AI across multiple industries. Companies collaborate with federal entities like the Pentagon to develop advanced solutions in security and defense, giving the country a strategic edge in global competition.

Infrastructure for startups

In the U.S., a robust ecosystem of accelerators, incubators, mentorship networks, and technical support fosters rapid idea validation, product testing, and market launch. This supportive framework helps entrepreneurs bring innovations to life faster.