Setting up a company in the United States can unlock significant opportunities: access to one of the largest consumer markets, a stable economy, and a favourable environment for innovation. In 2022 alone, over 5 million new companies were registered in the U.S., demonstrating the country’s appeal to entrepreneurs worldwide.

However, establishing a business in the U.S. requires careful analysis. Intense competition, intricate tax laws, and state-specific regulations can be challenging. For instance, Delaware is known for its low corporate taxes, but it may not be ideal for local businesses. Before registering a company in the U.S., entrepreneurs must carefully select a business structure, obtain a taxpayer identification number, choose a state for registration, draft the necessary documents, and ensure compliance with reporting requirements. This article will explore ten key reasons for starting a business in the U.S. and as many potential pitfalls to consider carefully before making your decision.

1. A Reliable Legal System

When registering a company, you can create and accumulate assets—capital, intellectual property, real estate, etc. A critically important decision is whether these assets will be held under your name as an individual or managed by your company as a legal entity. Forming a company is often the wiser choice to mitigate risks like liability or corporate takeovers.

For this to work, your business needs a solid legal foundation—a jurisdiction where it can be registered and operated. The United States is one of the most secure jurisdictions, offering strong asset protection even in cases of economic or political instability. Should your business encounter unfair treatment, the American legal system will ensure the protection of your registration, ownership, and company management.

2. Avoidance of Offshore Companies

Owners of offshore companies might face challenges when opening bank accounts, as European banks are often unwilling to approve accounts due to high risks and strict regulations. In contrast, registering a company in the United States offers substantial advantages: U.S. companies are regarded more favourably, making it easier to open accounts and fostering greater trust among partners and clients.

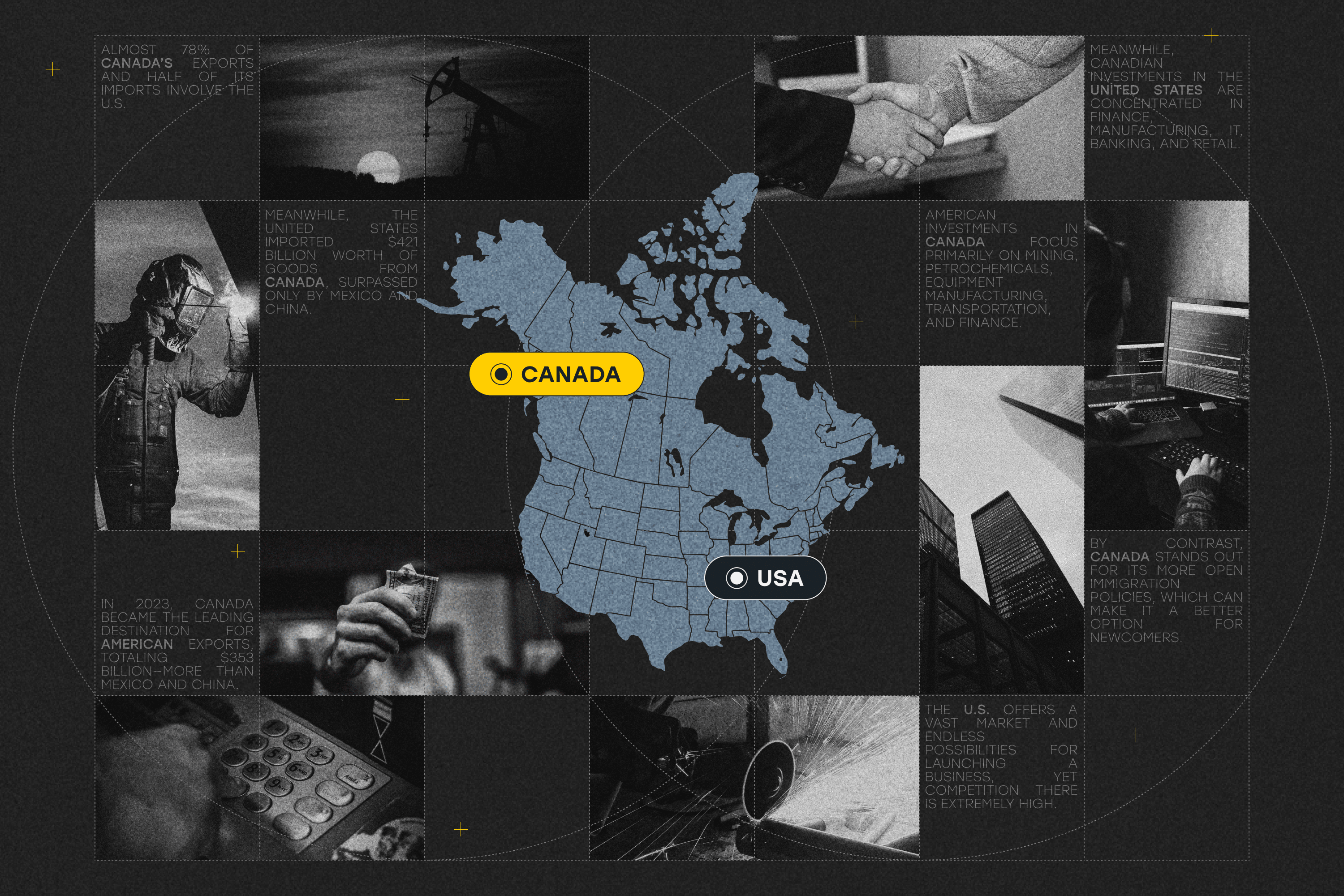

3. Americans Prefer Local Companies

Americans tend to favour partnerships with local companies over foreign entities. A business registered in states like Delaware or New York is generally seen as more trustworthy than one based in the jurisdictions of Cyprus or the British Virgin Islands. This is due to the convenience of resolving potential issues locally and the strong corporate governance standards in U.S. states like Delaware.

Local registration also simplifies verification: American companies can quickly verify business details through public registries, including the name and legal structure (e.g., Inc, Corp, or LLC). While foreign companies can operate in the U.S., establishing a locally registered entity is often a more practical and dependable solution.

4. Opening a U.S. Bank Account is Only Possible with an American Company

For non-residents, opening a business bank account in the U.S. without an American-registered company is nearly impossible. Major banks often decline applications from foreign entities due to rigorous compliance requirements, demanding proof of business registration in the U.S.

Without access to a U.S. bank account, businesses may face difficulties processing payments from platforms like Amazon, especially if you are part of affiliate programs. Therefore, registering a company in the U.S. eliminates these hurdles and simplifies financial transactions.

5. Access to Loans in the U.S. is Limited to Local Companies

U.S. banks generally provide loans exclusively to locally registered companies, making business registration essential for access to funding. Without it, access to financing will be significantly limited.

For registered businesses, term loans can reach up to $500,000 with competitive annual interest rates starting at 9%. Credit lines are also available, offering limits between $2,000 and $250,000, with interest rates ranging from 10% to 99% annually.

6. Attracting Investments in the U.S. is Limited to Local Companies

Registering a company in the United States substantially boosts your chances of securing investments, as investors, including venture capital funds and angel investors, typically prefer companies registered in the U.S. This preference is due to the reliable legal system, which provides greater protection for investors.

As highlighted in KPMG’s Q1 2024 report, North and South America attracted the largest share of global venture capital—$38.2 billion across 3,205 deals, of which $36.6 billion was invested in companies registered in the U.S.

7. Access to the World’s Largest Consumer Market

The United States hosts one of the largest consumer markets in the world, offering immense growth and profit potential. By registering a company in the U.S., businesses gain direct access to this market, enabling them to sell goods and provide services to millions of consumers.

According to the World Bank, in 2020, the U.S. GDP surpassed $21 trillion, cementing its position as the world’s largest economy. The high level of consumer spending on top of that creates an ideal environment for business success.

8. Thriving Environment for Startups and Innovation

The U.S. is globally recognized for its support of startups and innovation. Its advanced infrastructure, access to venture capital, and strong entrepreneurial support help new businesses scale quickly.

In 2020, venture capital investments in the U.S. surpassed $130 billion, according to the National Venture Capital Association (NVCA), reflecting the country’s commitment to innovation. Moreover, prominent tech hubs like Silicon Valley offer startups essential access to industry experts and networks.

9. Possibilities of Business Visas and Immigration Opportunities

Owning a U.S.-based company can significantly ease the path to securing business visas or alternative immigration statuses. Programs like the L-1 visa for intra-company transfers and the E-2 visa for investors enable entrepreneurs and investors to live and work legally in the United States.

10. Developed Infrastructure

The United States boasts a highly developed infrastructure that fuels business expansion. As reported by Mordor Intelligence, the U.S. transportation infrastructure construction market is forecasted to reach $371.25 billion in 2024, with a projected annual growth rate of 4.88%, climbing to $471.13 billion by 2029.

Moreover, government initiatives like the Bipartisan Infrastructure Law provide substantial funding for roads, bridges, and other critical projects, creating an environment where businesses can thrive and grow.

LET’S DISCUSS THE DOWNSIDES:

1. High Tax Rates

High state tax rates in the U.S. can impact a business’s profitability. For instance, corporate income tax in California stands at 8.84%, and at 6.5% in New York. Combined with federal taxes, this creates a substantial tax burden. Tax obligations are considerable in certain states, as highlighted by the Tax Foundation.

2. Complex Regulatory Environment

Operating a business in the U.S. requires compliance with a wide array of federal, state, and local regulations, often requiring licenses, permits, and regular reporting. This regulatory complexity can increase compliance costs and impose additional administrative burdens.

3. High Living and Rental Costs

In major U.S. cities such as New York, San Francisco, and Los Angeles, living expenses are steep and commercial real estate rent is high, which drives up operational costs for businesses. According to Statista, in 2020, the average office rental rate in Manhattan exceeded $80 per square foot.

4. High Competition

The U.S. market is highly competitive, especially in sectors like retail, financial services, and technology. Dominant players such as Stripe and PayPal control substantial market shares, creating significant barriers for new businesses to reach the level of the leaders. The demand for financial technologies, including mobile payments and digital wallets, is rapidly growing, and by 2026, the number of digital payment users in the U.S. is projected to reach 307 million.

New emerging companies might find it difficult to compete with well-established giants who have greater resources and loyal customers.

5. Challenges in Obtaining Business Visas and Work Permits

Foreign entrepreneurs often face a lengthy and challenging process when applying for U.S. business visas and work permits. Programs such as the L-1 visa for intra-company transfers and the E-2 visa for investors come with strict requirements and limitations. In the 2019 fiscal year, more than 10,000 E-2 visas were issued, highlighting the program’s appeal to international investors. However, despite its popularity, the application process remains highly competitive and demanding.

6. High Cost of Health Insurance

In the U.S., health insurance is a mandatory requirement, and employers are typically expected to offer coverage to their employees. However, the cost of health insurance might be quite substantial. According to the Kaiser Family Foundation, in 2020, the average annual premium for an employer-sponsored family health plan exceeded $20,000.

7. Tax Planning Complexities for International Businesses

International companies operating in the U.S. often encounter significant tax challenges, such as navigating transfer pricing regulations, profit repatriation taxes, and compliance with international tax treaties. Addressing these issues typically requires hiring tax experts, which can significantly increase administrative costs.

8. High Costs of Legal Services

Operating a business in the United States often involves substantial legal expenses, especially in navigating complex regulations or managing litigation. In 2020, legal services spending in the U.S. surpassed $330 billion, according to Statista. This highlights the importance of accounting for legal costs when planning business operations in the U.S.

9. The Rising Cost of Attracting and Skilled Employees

The competitive U.S. labour market drives higher wages and increased costs for retaining skilled employees. According to the U.S. Bureau of Labor Statistics, the average hourly wage in the private sector reached $29.81 in 2020. These elevated personnel expenses present a significant consideration for businesses operating in the country.

10. Litigation Risks

Operating a business in the U.S. comes with a high risk of lawsuits, including consumer class actions, which can lead to significant legal expenses and financial losses. The Institute for Legal Reform reports that total litigation costs in the U.S. surpassed $429 billion in 2016. This underscores the importance of considering litigation risks when doing business in the country.